Beauty and personal care products are usually value-driven products. Consumers often choose online grocery stores, online pharmacies, official websites of beauty and personal care brands, etc. Among them, multi-category retail e-commerce platforms such as Amazon are convenient It satisfies the psychological needs of consumers and thus attracts more traffic.

1. Overview of the e-commerce market

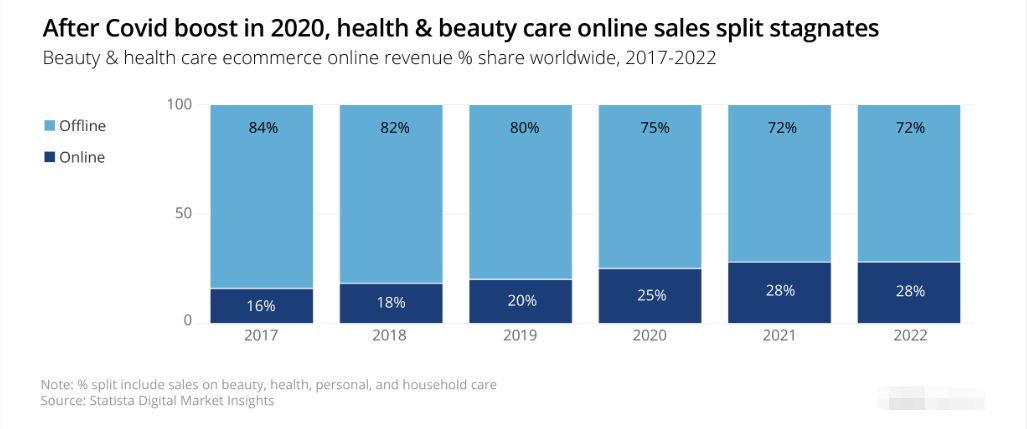

In general, the beauty and personal care market has been showing growth, and online sales will increase in 2022, but will continue to be slower than the growth rate in 2020 and 2021.

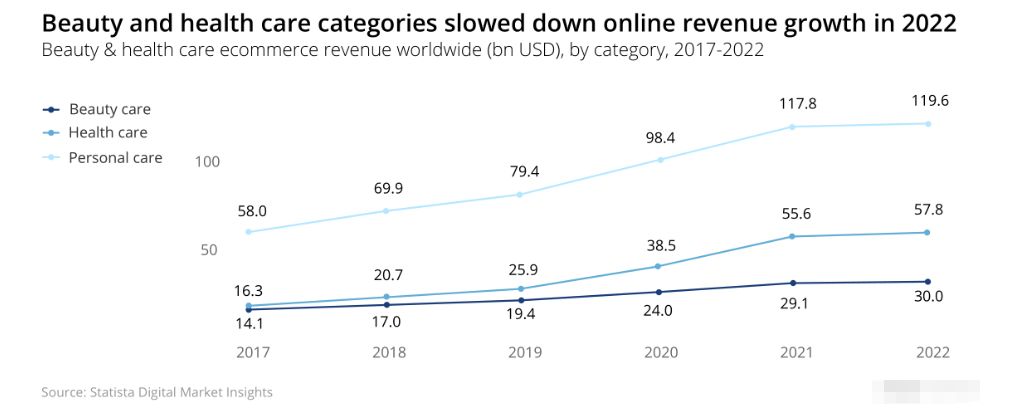

So far, the personal care category has occupied a major share of the beauty and personal care market, with global online sales of nearly US$120 billion in 2022, compared with US$79.4 billion in 2019. Personal care includes products such as soaps, shampoos, toothpaste and deodorants, reaching a wider consumer audience. Compared with other subcategories of the beauty and personal care market, the per capita consumption level of this subcategory is also higher.

2. Analysis of consumer portraits

During the epidemic, consumers’ shopping habits have gradually shifted to online, which has brought pressure on retailers and brands to accelerate the pace of digital transformation and improve logistics fulfillment capabilities. At the same time, online sales during the epidemic have also undergone drastic changes. European online sales of personal care in 2020 increased by 26% compared to 2019.

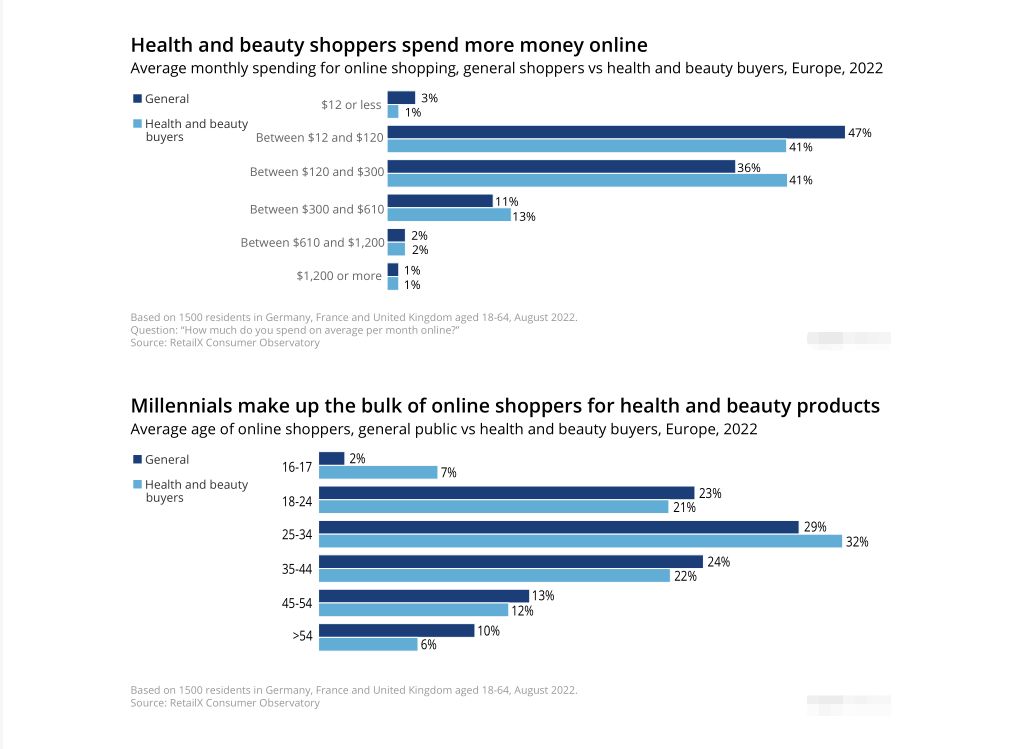

In addition, beauty and personal care consumers in Europe have a high level of spending. Most online consumers spend more than US$120 a month on average, and 13% of online consumers spend as much as US$600 a month. At the same time, the majority of online beauty and personal care consumers belong to the millennial generation. Consumers aged 25 to 34 account for 32% of beauty and personal care consumers and 29% of the total online consumers.

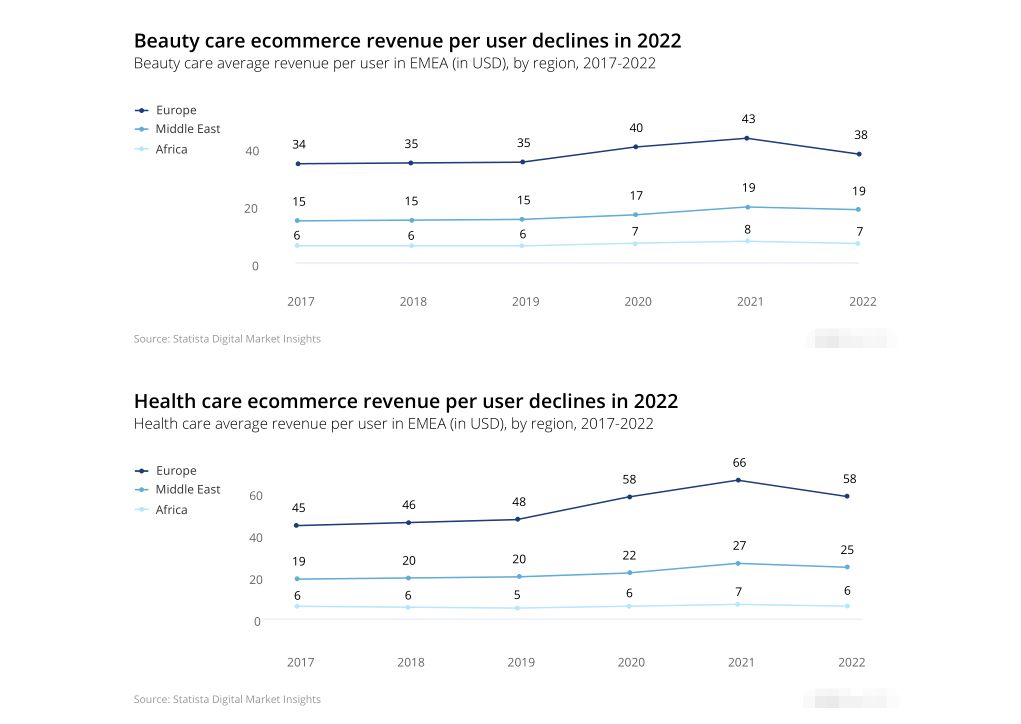

25% of European online consumers say they are more likely to buy beauty and personal care products online than in-store, which is much higher than 15% in the Middle East and 8% in Africa. This ratio will continue to change as the number of beauty and personal care consumers in the Middle East continues to increase.

Price and convenience of online channels are very important to consumers. 38% of British consumers will directly choose online channels for shopping. They “don’t care where they buy from, as long as the product is usable”. 40% of US consumers, 46% of Australian consumers and 48% of German consumers hold the same view. Therefore, the retention rate of consumers in merchants’ online channels will become more important.

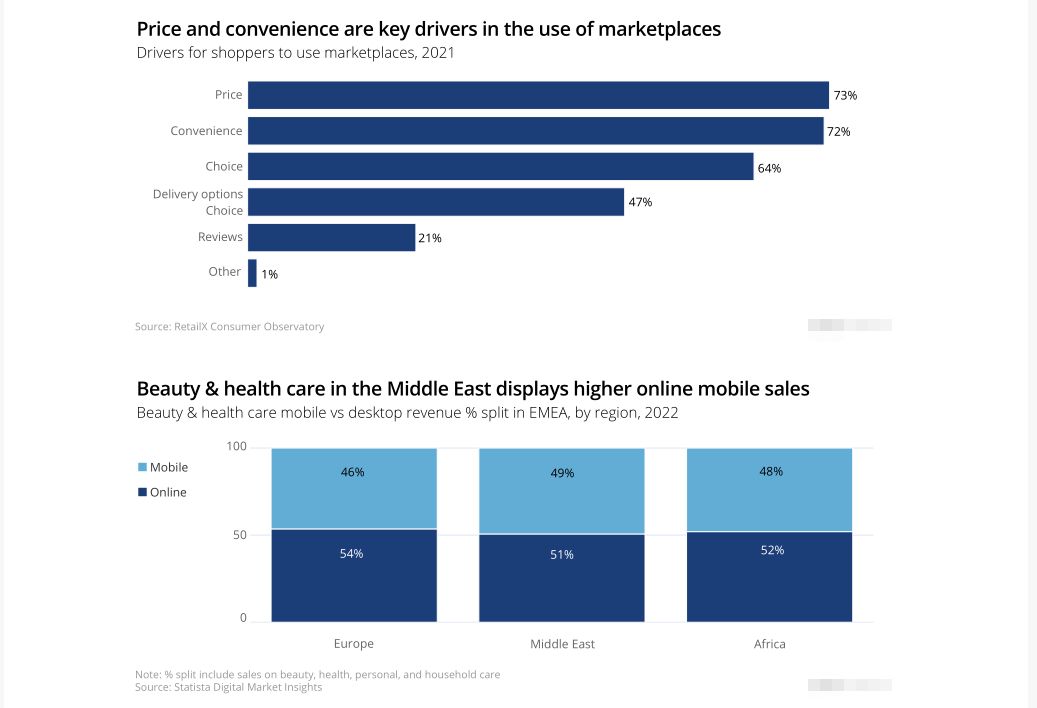

When European consumers are asked why they choose third-party e-commerce platforms, the main reasons they give are price (73%) and convenience (72%). As consumers in many countries face inflation and cost of living crises, the advantages of online channels will be further amplified.

3. Market Analysis of Three Major Regions

Europe is the main regional market for the beauty and personal care category, but the Middle East and Africa have higher growth rates.

• the Middle East

Due to their large populations, Iran and Turkey are the beauty and personal care markets in the Middle East, with a market size of US$6.7 billion in 2022.

Israel’s population of 9.2 million is far smaller than Iran’s or Turkey’s 84 million, but the country’s consumers spend much more in the beauty and personal care category.

Young consumers in the Middle East are very keen on using smartphones and social media, and the per capita GDP of some countries is also very high. Consumers in the Middle East say third-party platforms are their preferred shopping channel, which is on par with consumers in Asia.3. Market Analysis of Three Major Regions

Europe is the main regional market for the beauty and personal care category, but the Middle East and Africa have higher growth rates.

• the Middle East

Due to their large populations, Iran and Turkey are the beauty and personal care markets in the Middle East, with a market size of US$6.7 billion in 2022.

Israel’s population of 9.2 million is far smaller than Iran’s or Turkey’s 84 million, but the country’s consumers spend much more in the beauty and personal care category.

Young consumers in the Middle East are very keen on using smartphones and social media, and the per capita GDP of some countries is also very high. Consumers in the Middle East say third-party platforms are their preferred shopping channel, which is on par with consumers in Asia.

Post time: Apr-04-2023